Financing & Costs

BEND ADU GUIDE

Financing & Costs

BEND ADU GUIDE

Before and After You Build an ADU

There are many things to consider when building an ADU, not the least of which is cost. We’ve answered common questions relating to various costs associated with building an ADU, financing, resale value and how it will affect your property taxes.

Placeholder

The costs to build an ADU can vary quite a bit. Depending on the type of ADU, the square footage and the finishes, among several other factors, ADU costs can range from $80,000 to $400,000. For the purposes of this site and assuming the entire project is contracted out to a builder, the estimated amounts below are for Construction Costs only. (Other costs to consider: design/blueprints, permitting, lot preparation and utilities, and landscaping.)

How Much Does It Cost to Build An ADU?

The costs to build an ADU can vary quite a bit. Depending on the type of ADU, the square footage and the finishes, among several other factors, ADU costs can range from $80,000 to $400,000. For the purposes of this site and assuming the entire project is contracted out to a builder, the estimated amounts below are for Construction Costs only. (Other costs to consider: design/blueprints, permitting, lot preparation and utilities, and landscaping.)

CONSTRUCTION COSTS

What Financing Options Are Available?

CASH

One of the easiest ways to finance your ADU is with your cash savings. Financing the construction of your ADU with cash may be a worthwhile investment alternative to leaving cash in low-yielding investments, particularly if you plan to rent the unit. While financing the project with cash will provide flexibility during the construction process, it is not feasible for everyone and requires a significant amount of cash savings.

CASH-OUT MORTGAGE REFINANCE

A cash-out refinance allows you to access the equity in your home and can be an excellent source of cash to help finance an ADU project. A cash-out refinance will provide a lump sum payment that can be used to help fund construction costs. Since it is a mortgage, you will pay this amount back in monthly mortgage payments over time. This option could be especially attractive for individuals who would also like to refinance their existing mortgage, potentially lower their interest rate, or consolidate other debts into one monthly payment. Please note that these mortgage programs are subject to loan-to-value limitations imposed by lenders and not everyone will have enough equity in their home to make this a viable option for financing an ADU.

HOME EQUITY LINES OF CREDIT (HELOC)

Similar to a cash-out refinance, this option also allows you to access the equity in your home that can be used to help finance an ADU project. Unlike a cash-out refinance which provides a lump-sum payment that is paid back over time, a HELOC is a line of credit that can be accessed and paid back as needed to help fund construction costs. In this respect, HELOCs provide more flexibility than cash-out mortgage refinances but typically carry a variable interest rate, which means that the interest that you pay could increase or decrease every month. The interest rates on HELOCs are also generally higher than on mortgages. Similar to cash-out refinances, this option will also be subject to loan-to-value limitations imposed by lenders and therefore will not work for those without sufficient equity in their homes.

CONSTRUCTION OR RENOVATION LOAN

Another option to help finance the cost of your ADU is a construction or renovation loan. These loan programs are typically based on the future value of your property rather than the existing value, making this an option for those without sufficient equity for a cash-out refinance or HELOC. These loans typically have higher interest rates and closing costs than mortgages or HELOCs and can introduce complexity into the construction process. For instance, you may need to have your general contractor qualified with the bank, they may need to submit construction draw schedules/requests to the bank, periodic inspections may be required, and there can be additional limitations on budget and cost overruns.

For a list of local lenders, see these Bend Chamber member mortgage companies.

OTHER OPTIONS

Other potential options include personal loans, personal lines of credit, local/specialized financing programs with local banks or credit unions, or government grant and loan programs.

If I Build An ADU, How Will That Affect My Resale Value?

An ADU will very likely affect your resale value. The exact rate will depend on comparison values in your neighborhood.

How Does This Impact My Property Taxes?

First, let’s define some common Oregon property tax terms:

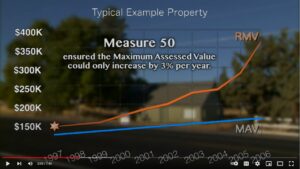

REAL MARKET VALUE (RMV)

This is the typical price your property would sell for in a transaction between a willing buyer and a willing seller on January 1, the assessment date for the tax year.

MAXIMUM ASSESSED VALUE (MAV)

This is the taxable value limit established for your property. The first MAV for each property was set in the 1997–98 tax year. For that year, each property’s assessed value was rolled back to its 1995-96 real market value, 10% less. This value can not grow faster than 3% per year unless activity, like new construction, occurs on the property.

CHANGED PROPERTY RATIO (CPR)

This is the method in determining how new improvements to a property are assessed. It is defined by the ratio of assessed to real market value of other property in the same area and class. If new construction occurs, the new property is added to the tax roll using the average changed property ratio.

For answers on how new construction will specifically impact your property, contact the Deschutes County Assessor’s office.

Deschutes County Property Tax Values—informational video:

Understanding the Difference between MAV and RMV—informational video:

The Bend Chamber is actively supported by these Signature Investors

Small Business

ANNUAL INVESTMENT: $425